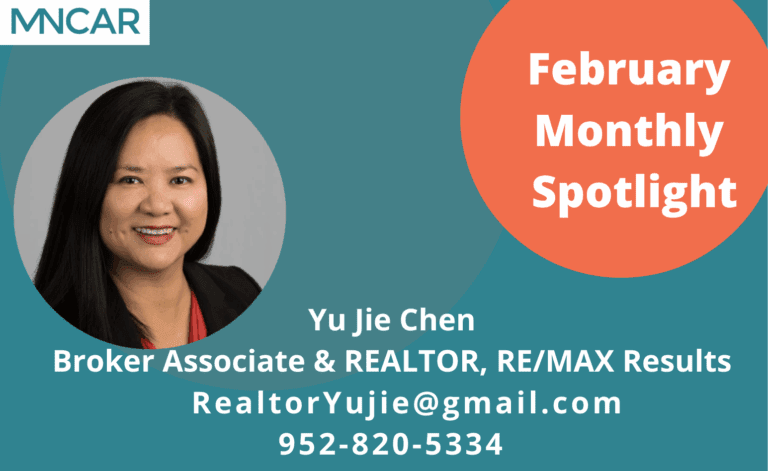

MNCAR – Monthly Spotlight- Yu Jie Chen

1. Why did you join MNCAR and how long have you been a member?

I joined MNCAR to market my first commercial real estate listing and that was about 7 years ago.

2. In one sentence, what do you want MNCAR members to know about your business?

I sell business opportunities, commercial real estates and do commercial leasing.

3. Name one fun fact that makes your company or yourself different from others.

I speak 3 dialects of Chinese (Taishanese, Cantonese, and Mandarin).

4. What has been your biggest professional achievement?

I am recipient of the RE/MAX Lifetime Achievement Award, the RE/MAX Hall of Fame, the RE/MAX Chairman Club Award, and 6 times RE/MAX Platinum Awards, the IBBA Outstanding Producer Awards and the IBBA Deal Maker Awards

5. Any other fun information you would like to share?

My family and I ended 2025 by visiting Malaysia and Korea.

To submit yourself or another MNCAR member for a monthly spotlight profile, email lindsey@mncar.org